The Buzz on Wealth Management

Rumored Buzz on Wealth Management

Table of ContentsGet This Report about Wealth ManagementWealth Management Things To Know Before You BuyOur Wealth Management StatementsGetting The Wealth Management To WorkMore About Wealth ManagementThe Of Wealth Management

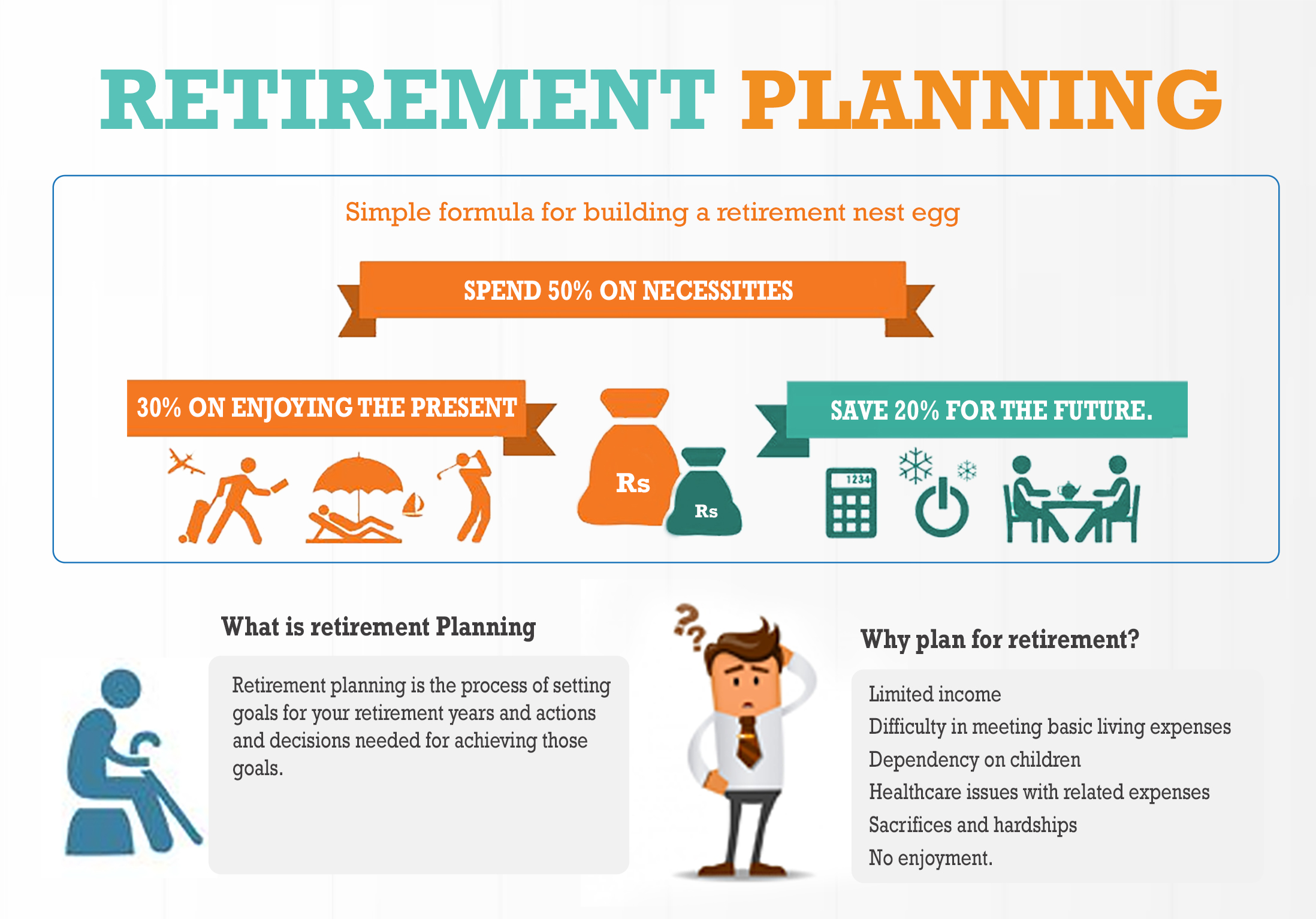

However, numerous do not have access to an employer-sponsored retirement, such as a 401( k) strategy. Even if your company doesn't supply a retired life plan, you can still save for retirement, by putting money in a Specific Retirement Account (IRA). Sluggish as well as stable wins this race.While your retirement might seem a long means off, you owe it to on your own to look toward the future as well as start thinking of what you can do today to aid make sure a protected retirement tomorrow. Although time might get on your side, if you ask several of the retired people you know, they will probably inform you that conserving for retired life is not as basic as it at first shows up.

Several individuals do not understand the possibly severe impacts of inflation. At 35 years, this amount would certainly be further lowered to just $34. Thus, it is essential to seek retired life cost savings lorries that have the ideal chance of outpacing inflation.

The Definitive Guide for Wealth Management

The earlier you identify the results that financial pressures can have on your retired life income, the more probable you will be to embrace approaches that can aid you accomplish your long-term goals - wealth management. Being positive today can aid increase your retired life financial savings for tomorrow.

If preparing for retired life appears like it could be boring or difficult, believe once again It's your opportunity to consider your objectives for the future and also shape a new life survived on your terms. Taking a bit of time today to think of your life in the future can make all the difference to your retirement.

A retired life strategy aids you obtain clear on your objectives for the future, such as just how you will invest your time, where will you live and whether your partner really feels the same. Recognizing when you prepare to retire makes it much easier to prepare. Some points to take into consideration consist of the age you can retire, tax outcomes and also revenue requirements.

Wealth Management Can Be Fun For Everyone

Retirees and pre-retirees face some unique threats when it comes to their investments.

A retired life strategy will certainly explore your alternatives consisting of profits from part-time work, investment revenue, the Age Pension and extremely savings. Collaborating with a knowledgeable retired life organizer can assist supply economic security and satisfaction. It can give you self-confidence that you get on track to be able to do the points you want in retired life.

Below's why you ought to start preparing early on as opposed to when it's far too late. Retirement takes you to a brand-new phase of your life wherein you can genuinely helpful resources make time for on your own and also delight in tasks that you have not been able to pay attention to throughout your job life.

The smart Trick of Wealth Management That Nobody is Discussing

Spending in a retirement plan is needed to guarantee this very same standard of living post-retirement. That will aid you with a steady income every month even after retiring.

This indicates that an individual will need to pay more for all expenditures in the future. Therefore, while doing important retired life preparation, you can consider this factor and also produce a sufficient retired life fund for your future to live a relaxed life. After your retired life, you shouldn't rely on any individual, especially your family members.

A Biased View of Wealth Management

With all these advantages as well as even more, you can not deny the reality that this is without a doubt a great financial investment possibility to offer up on. That's appropriate start today!. Since you have actually recognized the significance of retired life preparation, you can start by improving your clever retirement today.

Planning for retirement is a method to help you keep the exact my company same lifestyle in the future. You may not want to function for life, or be able to fully depend on Social Protection. Retired life planning has five actions: understanding when to start, calculating just how much money read this article you'll need, setting top priorities, choosing accounts as well as picking investments.

Wealth Management - Truths

When you can retire boils down to when you wish to retire and when you'll have adequate money conserved to replace the income you receive from working. The earliest you can begin claiming Social Safety advantages is age 62. Nonetheless, by submitting early, you'll sacrifice a portion of your advantages.

As well as your advantage will in fact increase if you can delay it better, up until age 70. (since they want or have to), as well as several retire later on (once more, since they want or have to) - wealth management.

When should you start retirement planning? Also if you have not so much as considered retirement, every buck you can conserve now will certainly be much valued later.